The biennial event of a nationally significant American election is upon us with the US midterms. All 435 House seats and 35 of the 100 Senate seats are on the ballot on Tuesday. Joe Biden is so concerned that last week he hit the campaign trail, ramping up the rhetoric.

The Democrats are likely to lose control of the House and the upper chamber is on a knife edge. That (or rather the divided government it will create) is bad news for investors, according to Unhedged’s Rob Armstrong. FT columnist Janan Ganesh blames the voters.

Want to know more? This Thursday, FT journalists Edward Luce, Rana Foroohar and James Politi will be joined by veteran commentator Norm Ornstein for a subscriber-exclusive event assessing the US midterm results. Register free today and you can submit questions in advance for our panel.

You can get also subscribe to the Swamp Notes newsletter, which does an excellent job probing the intersection of money and power in American politics, and is currently free to read.

Across the Atlantic, the COP27 gathering in Sharm el-Sheikh, Egypt, provides a focus for climate change news over the coming days (and weeks). More than 100 world leaders will be attending, including Rishi Sunak after he found time in his diary, but not King Charles.

Again, you can get more insights from the FT. Starting Monday, FT Live will be hosting a series of in-person, virtual and hybrid discussions with leading thinkers on sustainability and senior FT journalists. Each one will complement the themes set out in the presidency programme that day. Register your interest here.

Economic data

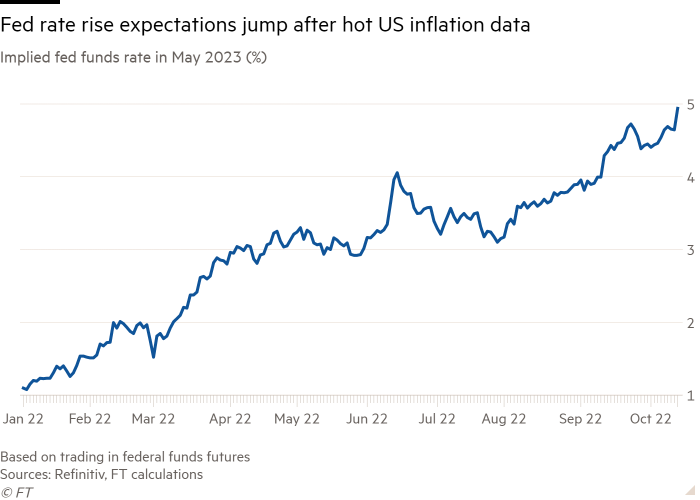

Inflation is the main theme of economic news this week with consumer price index and producer price index updates from the US, China, Germany and Japan. Whatever the US figure, Fed chair Jay Powell made it crystal clear in his comments last week that his team will do what it takes to squeeze inflation out of the economy. The consensus is for a 0.7 per cent increase in the monthly US figure to create an annual figure of 8.1 per cent.

The Bank of England’s gloomy projections last Thursday that the UK is entering its longest recession since the second world war sets the tone for this week’s big UK economic news item: the first estimate of third-quarter GDP on Friday. This is expected to show a contraction of about 0.2 per cent quarter on quarter.

Companies

With high street sales down in the UK and talk of a prolonged recession, British retail is not in a good place. But this week, might provide some respite — and we’re not just talking about the return of free coffee at Waitrose.

Marks and Spencer will on Wednesday present its first results under new management after the retirement of former chief executive and company lifer Steve Rowe over the summer. His replacement, Stuart Machin, has already set out his stall in terms of accelerating the overhaul of the store estate and redoubling cost-cutting efforts so the focus is likely to be on current trading. Rival Next last week stuck by its full-year guidance after sales held up in early autumn. M&S investors — who haven’t had a dividend since November 2019 — will be hoping Machin does likewise.

WHSmith profits are set for a bounce as the world’s travel industry recovers from Covid lockdowns. Travel revenue, much of which comes from airport stores, was already running well ahead of pre-pandemic levels at its last update in early September. Meanwhile, there were few hints of a slowdown in quarterly results from airport duty-free group Dufry last week.

The key constraint is capacity limits at major airports, notably London Heathrow. No doubt there will be further discussion of this on Monday when Ryanair reports first half numbers. Low-cost airlines like Ryanair are having to adapt to the end of, er, low-cost air travel, the answer to which has been to try to take business from the more expensive carriers.

The tail-end of the season’s tech earnings news is likely to continue the gloomy mood. Lyft, reporting on Monday, last week announced significant job cuts, its second round of redundancies in recent months. Lyft is not alone among tech firms having to tighten their respective belts, but it does not look good for the ride hailing service, a smaller rival to Uber, which is also selling its vehicle service business.

Elsewhere, we have a clutch of drugmaker updates. BioNTech, which reports on Monday, is among several Covid-19 vaccine producers that have begun raising the price of their jabs amid concerns about falling demand in 2023. Airfinity, a health data analytics group, forecasts sales of Covid vaccines falling by about a fifth to $47bn next year. There are also concerns about AstraZeneca, which reveals third-quarter figures on Thursday, after the nasal version of its Covid vaccine failed in trials. Better news is expected from German drugs and chemicals group Bayer, whose figures are out on Tuesday.

Read the full week ahead calendar here.