Sundry Photography/iStock Editorial via Getty Images

The week ending Sept. 30, saw a string of data come out, which included an unchanged Q2 U.S. GDP estimate and a lower than consensus corporate profit for Q2. However, Durable goods orders fell less than expected in August, and an improvement in consumer confidence for the second straight month was something to cheer for.

While Ryder lead the gainers (in this segment) on speculation of a takeover, two electric flying taxi stocks took a dip this week. Eve lead the pack, as it snapped out of a three-week winning streak, while an airline and an aero-defense stock were also among those hit. The SPDR S&P 500 Trust ETF (SPY) was in the red for the third week in a row (-2.93%), with 10 out of 11 sectors being in the red. YTD, SPY is -24.80%. The Industrial Select Sector SPDR (XLI) was also in the red for the third week (-2.25%). YTD, XLI is -21.71%.

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +5% each this week. However, YTD, all these five stocks are in the red.

Ryder System (NYSE:R) +12.87%. The Miami-based company’s stock surged the most on Sept. 27 (+14.69%) after reports that Apollo Global was exploring a takeover of the logistics and transportation provider. The stock dropped a bit two days later on news that a group of banks shelved a deal to help fund Apollo’s acquisition of telecom and broadband assets from Lume.

The SA Quant Rating on the shares is a Hold, which takes into account factors such as Momentum, Profitability, and Valuation among others. R has an A- factor grade for both Valuation and Profitability. The average Wall Street Analysts’ Rating concurs with a Hold rating of its own, wherein 7 out of 8 analysts tag the stock as Hold. YTD, the stock have shed -8.42%.

Builders FirstSource (BLDR) +8.83%. The Dallas-based company has come back among the top five weekly gainers after about three months; the stock shot up the most on Sept. 28 +7.68% as the broad market gained (The S&P 500 snapped out of a six-day losing streak on Sept. 28 but slumped in the remaining two days). However, YTD, BLDR has fallen -31.26%, the most among this week’s top five gainers for this period. The SA Quant Rating on BLDR is Strong Buy, with Growth possessing a score of C and Momentum with a factor grade of B+. The average Wall Street Analysts’ Rating agrees with its own Strong Buy rating, wherein 9 out of 13 analysts see the stock as such.

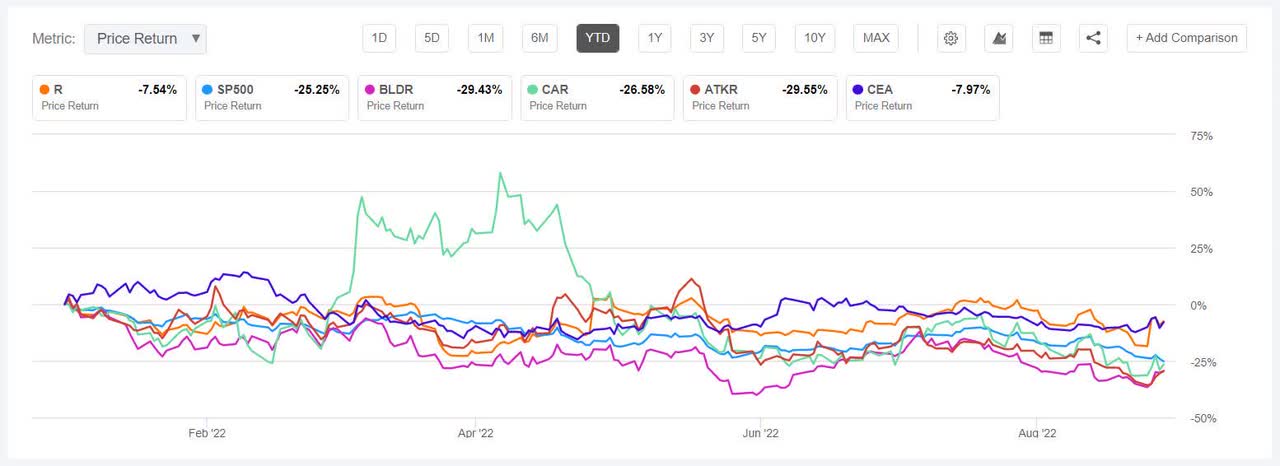

The chart below shows YTD price-return performance of the top five gainers and SP500:

Avis Budget (CAR) +7.39%. The top performing stock of 2021 (+455.95%) (in this segment) gained on Sept. 28 as well (+7.02%). But YTD, the car and truck rental company’s shares have declined -28.41%. The average Wall Street Analysts’ Rating on CAR is Hold, wherein 3 out of 5 analysts see the stock as such. The SA Quant Rating is also Hold, with Profitability possessing a score of A, while Growth with a factor grade of B-.

Atkore (ATKR) +6.97%. The Harvey, Ill.-based electrical products maker has a SA Quant Rating of Hold, with a factor grade of C for Momentum and an A score for Valuation. The average Wall Street Analysts’ Rating differs with a Buy rating, wherein 3 out of 4 analysts see the stock as Buy. YTD, the stock has declined -30.02%.

China Eastern Airlines (CEA) +5.31%. The Shanghai-based company’s stock has too come back among the top five gainers after about three months. The SA Quant rating on the stock is Hold, with Profitability possessing a factor grade of D while an A+ score for Growth. The rating is in contrast to one Wall Street Analyst’s Rating of Strong Buy. YTD, the stock has declined -6.76%.

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -8% each. YTD, all these five stocks are in the red.

Eve Holding (NYSE:EVEX) -21.56%. The Florida-based eVTOL aircraft maker’s stock was volatile this week, having fallen -18.47% on Sept. 27 but gained the next day (+14.17%) and fell again the next two days. In the week, the company signed a non-binding order of up to 200 eVTOL with FlyBlade India.

The SA Quant Rating on the shares is a Hold, with an F factor grade for Profitability and Valuation both. The rating is in contrast to the average Wall Street Analysts’ Rating of Buy, wherein 2 out of 4 analysts tag the stock as a Strong Buy. YTD, the stock has shed -9.23%.

MasTec (MTZ) -12.94%. The stock declined the most on Sept. 29 (-7.32%). Earlier in the week, the Florida-based infrastructure construction company extended the deadline for its exchange offer on Infrastructure and Energy Alternatives’ outstanding bonds. The average Wall Street Analysts Rating on the stock is Strong Buy, wherein 8 out of 12 analysts see the stock as such. The SA Quant Rating differs with a Hold rating, with Growth possessing a D score and Momentum with a factor grade of C+. YTD, the shares have declined -31.19%.

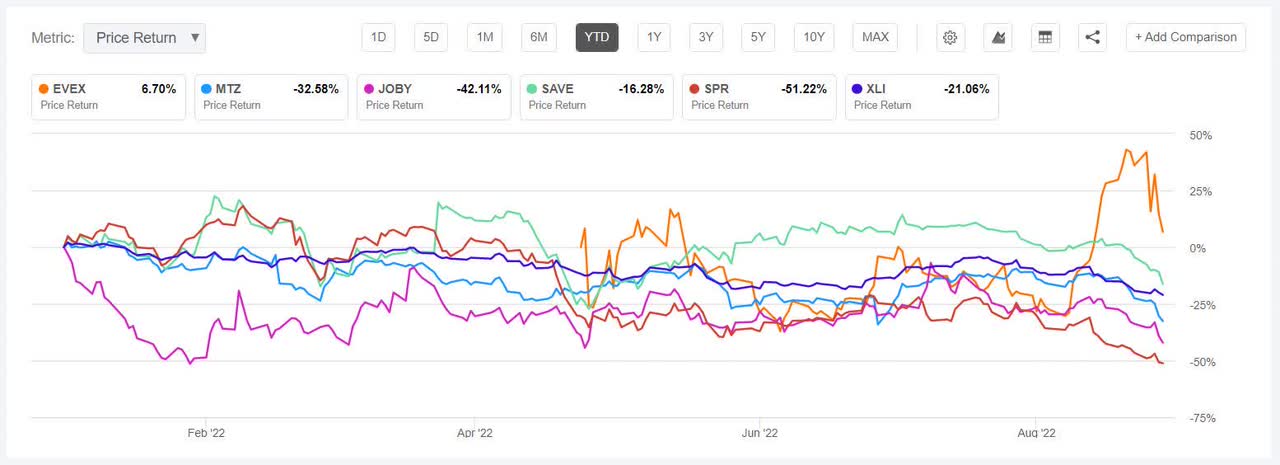

The chart below shows YTD price-return performance of the worst five decliners and XLI:

Joby Aviation (JOBY) -12.53%. A study by Bleecker Street Capital, a hedge fund led by Chris Drose, claimed that the electric taxi maker presented a too optimistic view of its manufacturing capacity to investors, while making modest production plans for its Marina, Calif.-based current factory, CNBC reported on Sept. 30. The stock fell the most this week on Sept. 29 (-9.00%). Meanwhile, SA contributor Pinxter Analytics wrote in a Sept. 28 piece that it was neutral on the company’s short-term prospects and slightly bearish on its long-term ones. YTD, the stock has slumped -40.68%.

The SA Quant Rating on Joby is Hold, with a D- score for Profitability and F for Valuation. The average Wall Street Analysts’ Rating differs with a Buy rating, wherein 4 out of 6 analysts see the stock as Hold.

Spirit Airlines (SAVE) -12.38%. The stock slumped -5.99% on Sept. 30 after a NYSE notice on a $2.50/share special dividend associated with the company’s planned sale to JetBlue. YTD, the stock has fallen -13.87%.

Spirit AeroSystems (SPR) -8.67%. The Wichita, Kan.-based company’s stock has plummeted -49.13% YTD, the most among this week’s worst five decliners. The SA Quant Rating on the stock is Strong Sell, with Growth carrying an F score and Momentum with a D- factor grade. The average Wall Street Analysts’ Rating differs with a Buy rating, wherein 8 out of 14 analysts seeing it as a Strong Buy.