I’ve been investing for about 15 years. During that time, the vast majority of my investments have gone toward individual stocks. But I recently put a significant amount of my wealth, about 12%, into an exchange-traded fund, or ETF.

The ETF provides exposure to a segment of the market where I previously had none. It was a big hole in my portfolio, but it presents a great opportunity for long-term investors. And that opportunity looks increasingly appealing in today’s market.

While I could’ve done the research to learn about specific stocks in this segment, there were several reasons why I felt an ETF would work out better than relying on individual names. So, in the recent market sell-off, I bought shares of the Avantis U.S. Small Cap Value ETF (NYSEMKT: AVUV).

Why I finally pulled the trigger

Small-cap stocks have fallen out of favor recently. And by “recently,” I mean the last decade. Small-cap value stocks have fared even worse.

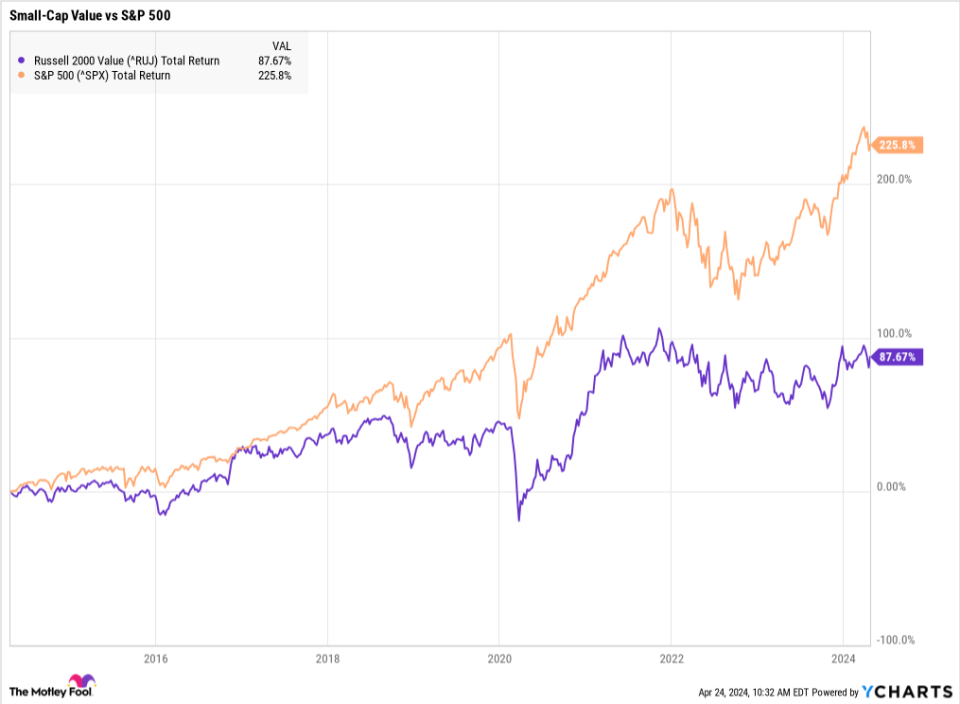

Here’s how the return of the Russell 2000 Value Index compares to the S&P 500 over the past 10 years.

Small-cap value stocks have underperformed large-cap stocks in seven of the last 10 calendar years.

That’s led to a significant valuation gap. Small-cap stocks traded at 17% below their historic average forward price-to-earnings (P/E) ratio at the end of 2023. Meanwhile, large-cap stocks traded for 15% above their historic average, according to data compiled by American Century. That shows up in the Avantis U.S. Small Cap ETF’s trailing P/E ratio of 7.8, compared to the S&P 500, which has a trailing P/E of 26.2.

The valuation gap between small-cap and large-cap stocks hasn’t been this big in decades. That suggests there’s a lot more upside potential for small-caps than there is downside risk. That’s especially true given the very long-term historical trends.

Over the very long run, small-cap value stocks are the strongest-performing group of stocks in the investable market. And while that hasn’t worked out lately, there are fundamental reasons why it should remain true in the future. Specifically, small companies should have a higher risk premium. That is, since smaller companies are usually riskier investments than large, well-established businesses, investors demand a larger expected return.

That risk premium has only gone up recently due to the Federal Reserve’s interest rate policies designed to combat inflation. As interest rates rise, the risk-free rate rises, and thus the risk premium rises. So, when investors demand higher returns from their small-cap stocks over the long run, it means the stock price must go down today, so it can produce higher returns in the future. But for long-term investors, it presents a buying opportunity.

Why I went with an ETF

Researching large-cap stocks is easy. On top of the quarterly financial reports every publicly-traded company is required to provide, there’s a lot of news coverage and Wall Street analyst notes to read. These stocks are highly liquid with thousands or millions of shares trading hands every day. In short, the market for large-cap stocks is extremely efficient.

Small-cap stocks are a different story. These are companies that relatively few people know about, there’s not a lot of news coverage, and very few analysts follow them. That makes these companies ripe for investors with an information advantage.

While I could take the time to build that information advantage by digging deep into annual reports and doing on-the-ground research, it’s just not something I have the time or inclination to do. I’d much rather stick with the easily accessible news and information about my favorite large-cap companies.

Buying an ETF that provides diverse exposure to small-cap value stocks is a much simpler way to go. I’ll happily pay a small fee for someone to do that for me.

Why this ETF?

The Avantis U.S. Small Cap Value ETF is technically an actively-managed fund aiming to outperform its benchmark index, the Russell 2000 Value Index. But the way it goes about selecting stocks is passive.

The company uses current valuations to overweight stocks with higher expected returns. One of its primary metrics is profitability to book value, which looks at operating profits as a percentage of its book value (assets minus liabilities). Filtering the Russell 2000 through its criteria leaves it with 765 holdings. The biggest holding is still less than 1% of the total portfolio.

I usually stay away from actively-managed funds. That’s often because they can’t outperform their fees. Avantis’s 0.25% expense ratio is a small hurdle, and I believe there’s more opportunity for the fund to outperform the benchmark index as small-cap stocks are less efficiently traded than large-caps.

Another deciding factor is that the Avantis U.S. Small Cap Value ETF provides greater exposure to the small-cap value segment of the market than many other small-cap value ETFs. For example, 58% of its holdings fall into the small-cap value category, according to Morningstar. By comparison, the Vanguard Small-Cap Value ETF invests just 33% of its assets in small-cap value stocks. (That’s entirely due to the index Vanguard chose to track for the fund. It does an incredible job tracking the selected index.)

While I’ll pay slightly more in fees with Avantis than other pure small-cap value index funds, the cost is worth it to me. An investor can get both greater exposure to the small-cap value segment of the market and the potential to outperform with Avantis’s selection criteria.

Should you invest $1,000 in American Century ETF Trust – Avantis U.s. Small Cap Value ETF right now?

Before you buy stock in American Century ETF Trust – Avantis U.s. Small Cap Value ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and American Century ETF Trust – Avantis U.s. Small Cap Value ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

Adam Levy has positions in American Century ETF Trust – Avantis U.s. Small Cap Value ETF. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

I Love Individual Stocks, but I Just Invested 12% of My Portfolio in This ETF was originally published by The Motley Fool